Yearly depreciation formula

Divide the balance by the number of years in the useful life. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

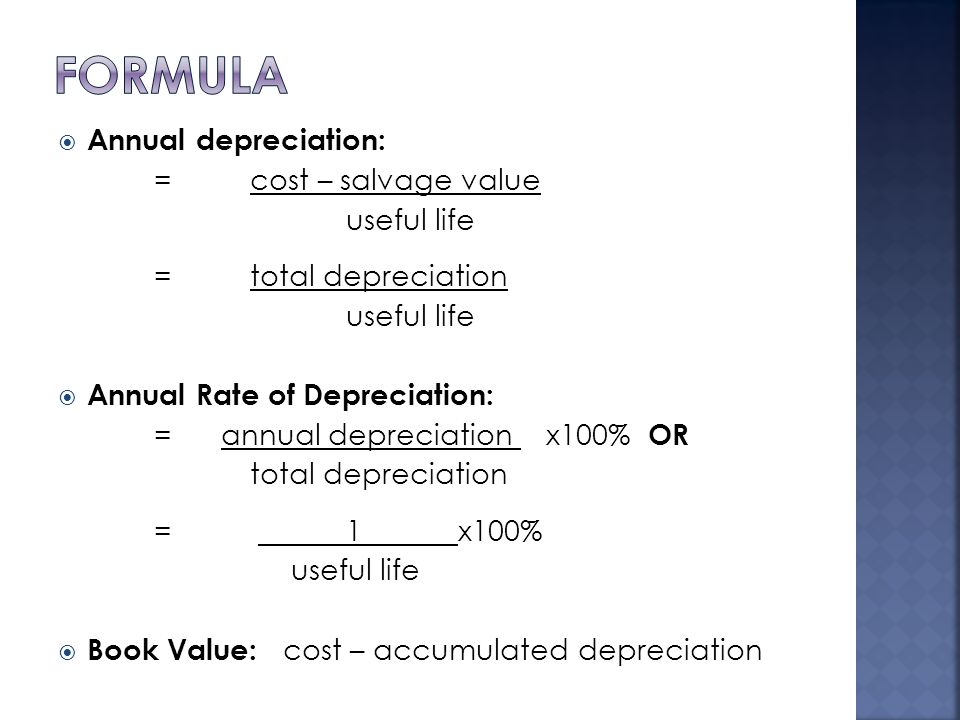

Depreciation Formula Calculate Depreciation Expense

It also refers to the spreading out.

. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan. You can use the following basic declining balance formula to calculate accumulated depreciation for years. The balance is the total depreciation you can take over the useful life of the equipment.

Calculate yearly depreciation to be booked by Mark Inc on 31122019 and 31122020. The following formula determines the rate of depreciation under this method. The formula for straight-line depreciation is.

The calculation of yearly depreciation under WDVM for 2019 and 2020 is as follows. WHO World Health Organisation also uses the average to know the yearly death and birth rate during a particular time. It is a contra-account the difference between the assets purchase price and its carrying value on.

The accelerated method makes the asset lose value at a faster rate than the straight-line method. For instance the Year 1 factor is 1055 the Year-2 factor is 955 etc. For simplicity assume that the only operating expense of the company is depreciation expense no rent expense wage expense etc.

The formula for calculating depreciation using each of these methods is given below. Divide the cost of the asset minus its salvage value by the estimated number of years of its useful life. 8000 divided by 5 years is 1600.

To calculate this value on a monthly basis divide the result by 12. Yearly Depreciation Value remaining. With Free Online Depreciation Calculation Tool you can calculate the total depreciation on a given asset using the Written Down ValueWDV method.

For example consider a company that generates yearly revenues of 100000. If you want to assume a higher rate of depreciation you can multiply by two. The yearly depreciation of that asset is 1600.

Accumulated depreciation recorded Accumulated Depreciation Recorded The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. Double declining balance method. Depreciation Amount Declining-Bal.

Final Year Depreciation Expense. Many companies and organizations use average to find out their average sales average product manufacturing average salary and wages paid to labor and employees. Relevance and Uses of Average Formula.

The depreciation per period the value of the asset minus the final value which is. Depreciation cost - salvage value years of useful life. Purchase cost- salvage valueuseful life.

X Number of Depreciation Days x Depr. Form the yearly factors by dividing the digits sum into the years remaining. Owns machinery with a gross value of 10 million.

It is essential to fill in the depreciation details correctly so let your companys accountant handle calculations related to depreciation. Basis 100. This gives you the yearly depreciation deduction.

Using depreciation in yearly accounting records ensures that they report the correct profit values in their income statement and balance sheet. D j C-S nn-j1T where T0. 1 nth root of Residual ValueCost of the asset 100 where n useful life.

Double-Declining Balance DDB Depreciation Method Definition With Formula The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a. Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset. It creates a more significant depreciation which allows for greater tax deductions and minimizing the taxable income during the assets first years.

Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value. 10000 minus 2000 is 8000. Yearly Depreciation Closing.

How is it calculated. To calculate use this formula. The straight-line depreciation formula is.

Read more on furniture. - For each asset choose between the Straight-Line Sum-of-Years Digits Double Declining Balance or Declining Balance with Switch to Straight-Line. The following formula calculates depreciation amounts.

Straight Line Depreciation Formula The following algorithms are used in our calculator. Annual factor x Depreciable amount. If you use this method you must enter a fixed yearly percentage.

The salvage value is the estimated amount of money the item. The SOYD depreciation formula is. This Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Calculator Store 60 Off Www Wtashows Com

Depreciation Rate Formula Examples How To Calculate

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Straight Line Depreciation Formula And Calculation Excel Template

Gt10103 Business Mathematics Ppt Download

Accumulated Depreciation Definition Formula Calculation

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Calculation

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Formula And Calculation Excel Template

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Rate Formula Examples How To Calculate

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Depreciation And Book Value Calculations Youtube